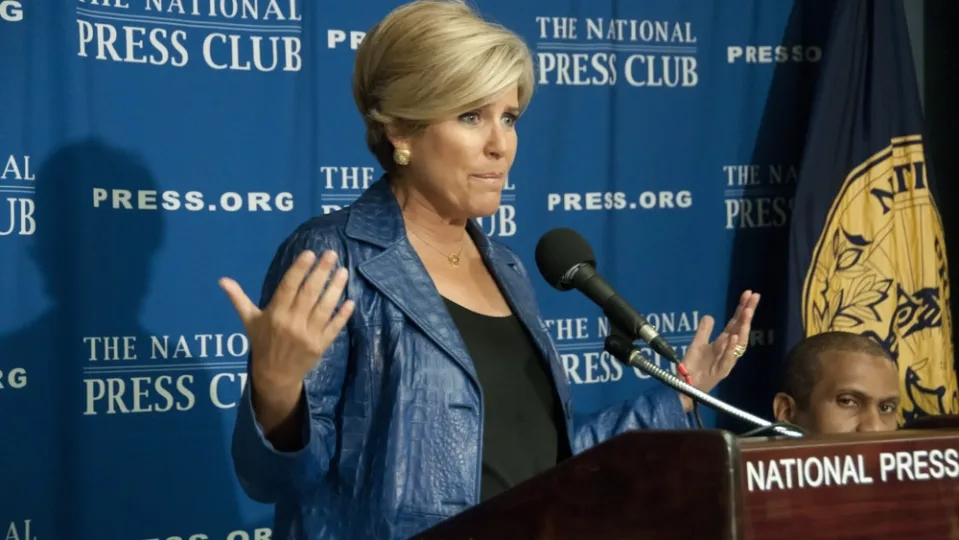

When considering a vehicle, the question often arises: should you lease or buy? Recently, CNN host Chris Wallace revealed that he leases a car, sparking a conversation with financial expert Suze Orman. Orman, known for her strong opinions on personal finance, didn’t hesitate to share her thoughts on the matter. In this article, we delve into the key points Orman raised and provide a deeper understanding of why buying a car might be a better long-term investment.

The Difference Between Leasing and Buying

Before analyzing Orman’s advice, it’s important to understand the basic differences between leasing and buying a car. Leasing allows you to drive a new vehicle for a specified period, typically two to four years, while paying monthly installments. At the end of the lease, you return the car unless you decide to purchase it. Buying a car, on the other hand, involves either paying in full or financing through a loan, with ownership transferring to you once payments are complete.

Leasing Pros:

- Lower monthly payments.

- Ability to drive new cars more frequently.

- Minimal maintenance costs due to warranty coverage.

Leasing Cons:

- No ownership at the end of the lease.

- Mileage restrictions and potential fees for wear and tear.

- Long-term cost can be higher than purchasing.

Buying Pros:

- Full ownership after the loan is paid off.

- No mileage restrictions.

- Potential to resell or trade-in for equity.

Buying Cons:

- Higher monthly payments compared to leasing.

- Maintenance costs increase as the car ages.

- Depreciation reduces the car’s value over time.

Suze Orman’s Take on Leasing vs. Buying

During the CNN interview, Suze Orman expressed her clear preference for buying over leasing. She argued that leasing a car is essentially “renting,” which leads to an ongoing expense without any long-term financial benefit. Orman is a strong advocate for financial independence and emphasizes the importance of owning assets rather than borrowing or leasing.

Why Orman Opposes Leasing

Orman’s main criticism of leasing revolves around the lack of ownership. According to her, leasing is equivalent to continually paying for a car that you will never own. This means there’s no potential to build equity or benefit from resale value, which is a critical factor for long-term financial growth.

In her view, the temptation to drive a new car every few years may seem appealing, but it ultimately leads to a cycle of debt. When you lease, you are committed to making payments for the duration of the lease term, and once the term is over, you’ll likely start a new lease and continue making payments indefinitely. This, Orman argues, is the opposite of building wealth.

The Financial Impact of Leasing

To further illustrate Orman’s point, let’s consider the financial implications of leasing versus buying over time. For example, leasing a car for $300 per month for three years adds up to $10,800. At the end of the lease, you’ll have no car to show for it. In contrast, financing a car for $400 per month over five years totals $24,000, but at the end of the loan term, you own the car and can continue driving it without monthly payments or sell it for its residual value.

This difference highlights the long-term cost savings associated with buying. While the monthly payment for buying might be higher, it eventually leads to ownership, which is a tangible asset.

The Benefits of Ownership in Wealth Building

Orman’s philosophy is rooted in the idea of ownership as a key pillar of financial stability. Whether it’s a home, a car, or other assets, owning gives you control over your finances and helps avoid the trap of perpetual payments. In the case of a car, once you’ve paid off the loan, you can continue using it for years without the burden of monthly payments.

Moreover, owning a car provides flexibility. If your financial situation changes or you decide you no longer need the vehicle, you can sell it, potentially recouping a portion of your investment. This option is not available with a lease, where you must return the car and, in some cases, pay fees for exceeding mileage limits or wear and tear.

Alternatives to Leasing

For those who may still be tempted by the lower monthly costs of leasing, Orman suggests considering alternatives. For instance, buying a certified pre-owned vehicle offers a middle ground between new and used cars. Certified pre-owned vehicles are typically newer models with low mileage that have passed rigorous inspections. They often come with extended warranties and lower price tags than brand-new vehicles, making them a smarter financial choice.

Another option Orman recommends is saving up for a down payment to reduce the overall cost of a car loan. A larger down payment reduces monthly payments and helps avoid the need for costly loans.

Conclusion: The Smart Financial Move

Suze Orman’s stance on car leasing versus buying is clear: ownership builds wealth, while leasing creates an ongoing financial burden. While leasing may offer lower monthly payments and the allure of driving a new car, it doesn’t provide the long-term benefits of ownership. For those looking to secure their financial future, buying a car, even with higher upfront costs, is a smarter decision in the long run. Following Orman’s advice can help individuals avoid the cycle of debt and work towards true financial independence.