Nvidia, the AI chipmaking giant and one-time contender for the world’s most valuable company, has hit a sudden rough patch. On Tuesday, Nvidia (NVDA) experienced the worst single-day loss in stock market history, measured by market value, with its shares plunging 9.5%. This dramatic fall wiped out an astonishing $279 billion in market capitalization, easily surpassing the previous record of $240 billion set by Meta in 2022.

To put the staggering loss into perspective, only 27 companies worldwide are currently valued as high as the amount Nvidia lost in one day. That $279 billion drop exceeds the total value of major corporations like McDonald’s, Chevron, and Pepsi.

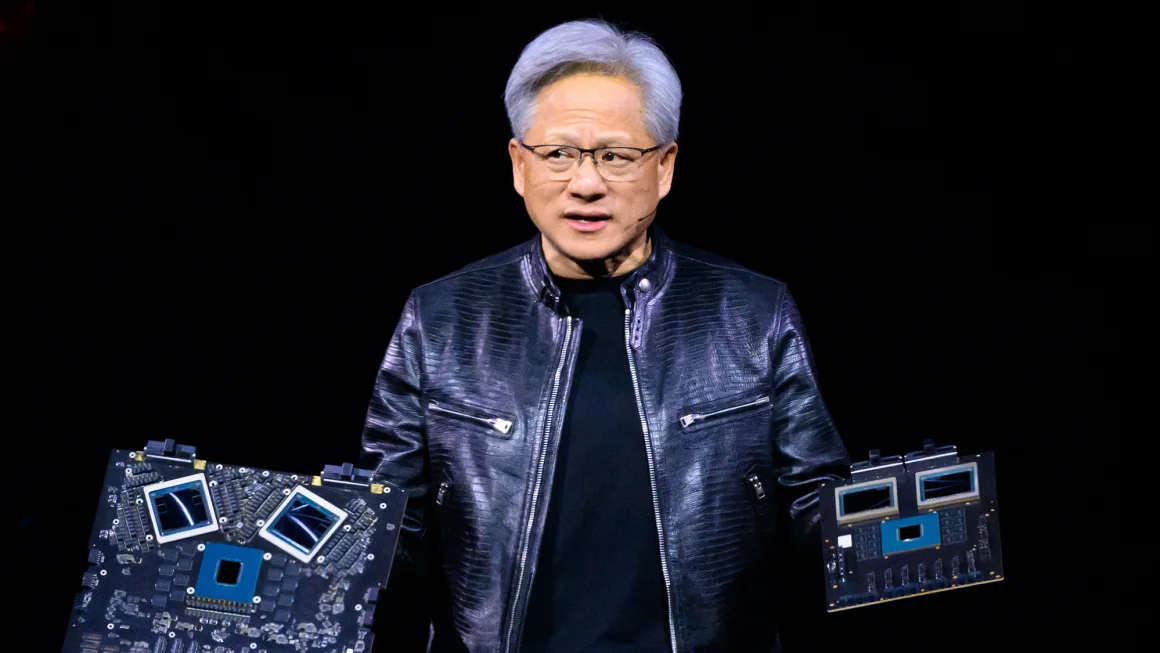

Jensen Huang, Nvidia’s CEO and largest individual shareholder, saw his personal wealth take a $10 billion hit due to the company’s stock slide. Nvidia’s market decline began after it reached an all-time high of $3.3 trillion in value on June 18, the highest for any public company at the time. However, with emerging concerns about the US economy, investors have grown cautious about Nvidia and other AI-related stocks, fearing that an economic downturn could deter businesses from investing in AI—a technology with massive potential but still fraught with uncertainty.

Despite posting strong earnings last week, Nvidia’s forecasted outlook underwhelmed investors hoping for a more optimistic projection, resulting in a continued stock decline.

Since its peak on June 18, Nvidia’s stock has dropped over 20%. Other tech heavyweights like Microsoft, which has also made significant investments in AI, have seen similar drops, with Microsoft’s stock falling 12% from its recent high. TSMC, the manufacturer of Nvidia’s chips, has also taken a hit, plummeting 18% since mid-July.

Meanwhile, Intel, which was once the world’s largest chipmaker, has seen a 59% drop in its share price this year. The company is grappling with its own set of challenges as it tries to pivot toward AI technologies.

This sudden setback highlights the volatility in the AI and tech sectors, as even leading companies face significant challenges in maintaining investor confidence amidst broader economic concerns.

Nvidia Faces Potential Legal Troubles Amid Antitrust Investigation

In addition to recent stock market challenges, Nvidia may soon be dealing with a different set of problems: potential legal scrutiny. Reports have surfaced suggesting that the U.S. government is investigating Nvidia for possible antitrust violations.

On Tuesday, part of Nvidia’s sharp market decline was attributed to a reported subpoena from the U.S. Justice Department, as part of an antitrust probe, according to Bloomberg. While CNN could not independently confirm the subpoena, the Department of Justice has not commented on the matter. However, Nvidia responded on Wednesday, stating that it has not been subpoenaed.

“We have inquired with the U.S. Department of Justice and have not been subpoenaed,” a company spokesperson said. “Nonetheless, we are happy to answer any questions regulators may have about our business.”

The Biden administration has been aggressive in scrutinizing major tech companies, launching investigations and filing charges against giants such as Apple, Google, and Amazon. It remains unclear whether a future administration, whether led by Kamala Harris or Donald Trump, would continue pursuing these cases, though both have criticized big tech during their campaigns for various reasons.

Nvidia’s stock took another hit on Wednesday, falling 1.7%. The broader Nasdaq Composite, which saw a 3% drop on Tuesday, also declined slightly by 0.3% on Wednesday.

Despite these legal uncertainties, many investors remain bullish on Nvidia. The company’s stock is still up 118% for the year, and it holds a market valuation of $2.7 trillion, positioning it closely behind tech giants Apple and Microsoft. Nvidia’s CEO, Jensen Huang, recently emphasized the soaring demand for the company’s latest AI chips, codenamed “Blackwell,” stating that demand “far exceeds supply.”

Huang also reassured investors that Nvidia’s investments are yielding returns. He pointed out that companies adopting Nvidia’s new graphics processing units (GPUs), which power AI applications, are seeing immediate benefits due to their data processing efficiency, ultimately helping businesses save money.

This optimism is shared by market analysts like Wedbush’s Dan Ives, who sees Nvidia’s stock dip as a buying opportunity. “Nvidia has transformed the tech and global landscape, with its GPUs becoming the new oil and gold in the IT world,” Ives noted in a recent investor memo.

While legal challenges may loom, Nvidia’s strong position in the AI and tech sectors continues to attract investor confidence.